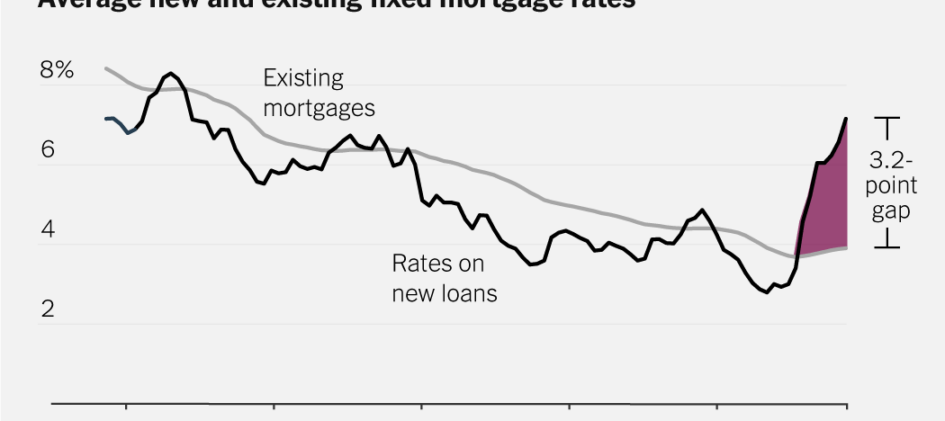

Something deeply unusual has happened in the American housing market over the last two years, as mortgage rates have risen to around 7 percent. Rates that high are not, by themselves, historically remarkable. The trouble is that the average American household with a mortgage is sitting on a fixed rate that’s a whopping three points […]

Read More