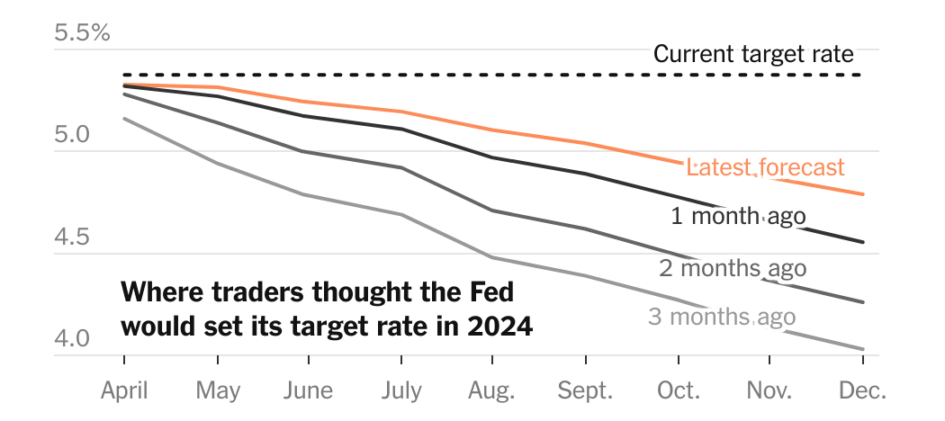

The markets are mercurial but their tone has thoroughly changed — from the sky-is-the-limit bullishness that dominated only a month ago to a mood of heightened uncertainty and measured self-restraint. Big shifts have taken place this month. Bonds have taken a beating but are becoming increasingly attractive. Stocks are no longer rocketing straight to the […]

Read More