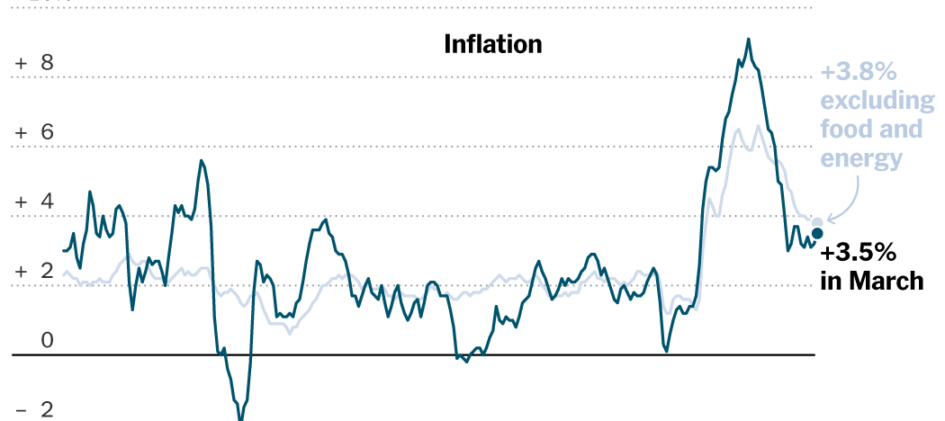

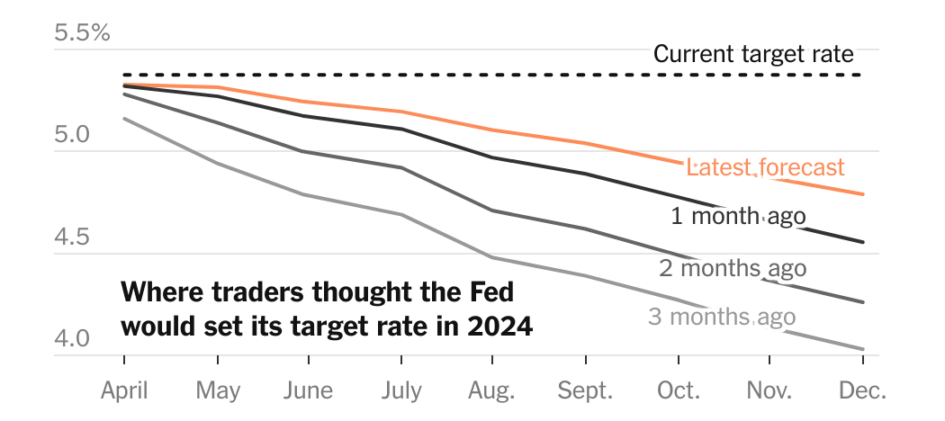

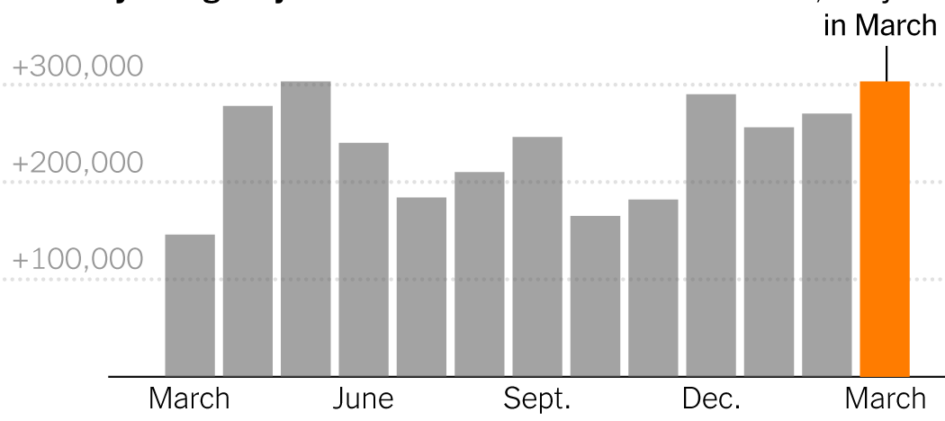

The path to a “soft landing” doesn’t seem as smooth as it did four months ago. But the expectations of a year ago have been surpassed. April 13, 2024 The economic news of the past two weeks has been enough to leave even seasoned observers feeling whipsawed. The unemployment rate fell. Inflation rose. The stock […]

Read More