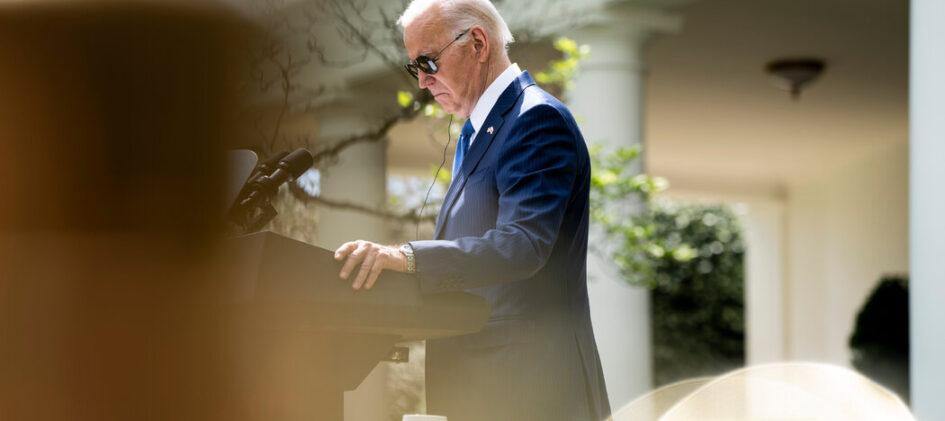

The Federal Reserve is likely to wait longer than initially expected to cut interest rates given stubborn inflation readings in recent months, the central bank’s top two officials said Tuesday. Policymakers came into 2024 looking for evidence that inflation was continuing to cool rapidly, as it did late last year. Instead, progress on inflation has […]

Read More