Trump Media stock closes 21% lower after company reports $58 million loss for 2023

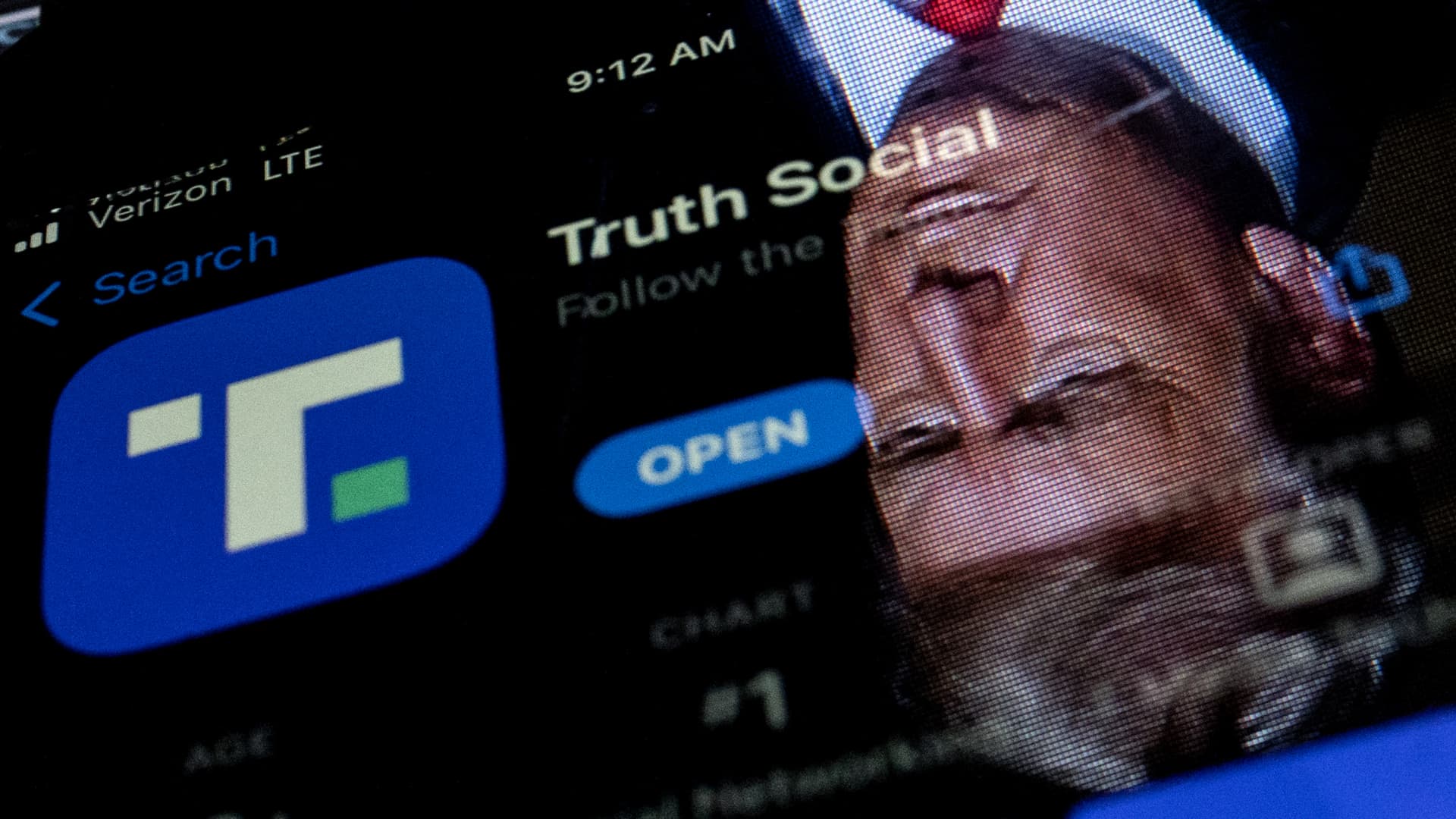

This photo illustration shows an image of former President Donald Trump reflected in a phone screen that is displaying the Truth Social app, in Washington, DC, on February 21, 2022.

Stefani Reynolds | AFP | Getty Images

The share price of Trump Media closed trading 21.47% lower on Monday, hours after the social media app company tied to former President Donald Trump reported a net loss of $58.2 million on revenue of just $4.1 million in 2023.

Trump Media & Technology Group shares plunged by more than 25% around 1:08 p.m. ET before recovering slightly later in the day.

Trump Media’s closing price was $48.66 per share, more than $30 lower than its high of $79.38 per share, which it hit last week on the heels of becoming publicly traded.

Despite Monday’s steep drop, the company’s market capitalization was still nearly $6.6 billion.

Earlier, Trump Media in its 8-K filing with the Securities and Exchange Commission revealed the loss for last year.

Much of the net loss appears to come from $39.4 million in interest expense, according to the filing.

A spokesperson for the company did not immediately reply to a request for comment.

The filing shows that in 2022, Trump Media had a net profit of $50.5 million and total revenue of only $1.47 million.

The company ended 2023 with just $2.7 million in cash on hand, the filing said.

The losses last year by Trump Media — the owner of the Truth Social app routinely used by the former president — could continue for some time, according to the company.

“TMTG expects to incur operating losses for the foreseeable future,” says the filing, which came a week after the company began trading under the ticker DJT on the Nasdaq.

The filing also warns shareholders that Trump’s involvement in the company could put it at greater risk than other social media companies.

TMTG also disclosed to regulators that the company had identified “material weaknesses in its internal control over financial reporting” when it prepared a previous financial statement for the first three quarters of 2023.

As of Monday, Trump Media said these “identified material weaknesses continue to exist.”

Trump owns 57.3% of Trump Media shares, a stake valued at $3.83 billion. Forbes last week reported that Trump’s existing shares represent well more than half of his total net worth.

He also stands to receive another 36 million shares of so-called earn-out shares over the next three years, as long as Trump Media’s stock during that time hits a series of price benchmarks. These targets are all well below the company’s stock price early Monday.

Trump Media’s share price rocketed when its stock began trading Tuesday, several days after the firm merged with a special purpose acquisition company, Digital World Acquisition Corp., which had been traded under the ticker DWAC. The newly merged company now trades under Trump’s initials, DJT.

Analysts note that the company’s high valuation is partly due to stock purchases by Trump’s political supporters, who are enthusiastic about owning part of a company so closely associated with the presumptive Republican presidential nominee.

That enthusiasm creates unique risks for the company, however. The new 8-K filing says that Trump Media “may be subject to greater risks than typical social media platforms because of the focus of its offerings and the involvement of President Trump.”

“These risks include active discouragement of users, harassment of advertisers or content providers, increased risk of hacking of TMTG’s platform, lesser need for Truth Social if First Amendment speech is not suppressed, criticism of Truth Social for its moderation practices, and increased stockholder suits.”